Stock option value calculator

Ad From big to small find the right size to fit your options trading strategies. Options Warrants Calculator.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

SPX suite of index options offers an array of benefits and product features.

. The current stock price. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Ad Trade on One of Three Powerful Platforms Built by Traders For Traders.

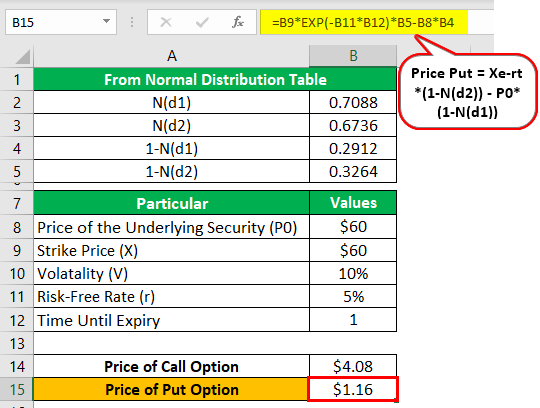

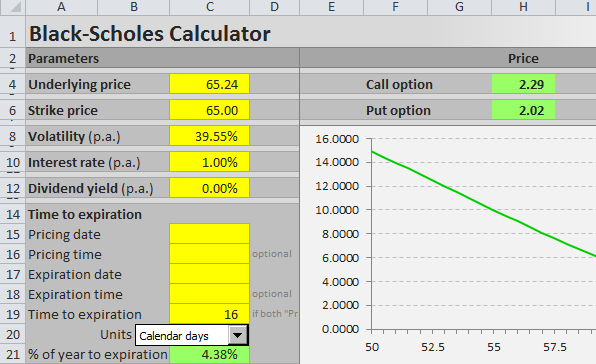

The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest. A derivative financial instrument in which the underlying asset is a debt security. Black-Scholes Calculator To calculate a basic Black-Scholes value for your stock options fill in the fields below.

Share price at the end of the term NOY years A CSP 1SGW100NOY Average strike price. Typically these options give their holders the right to purchase or sell an. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies.

Options involve risk and are not suitable for all investors. AMT Calculator Exercise incentive stock options without paying the alternative. On this page is an Incentive Stock Options or ISO calculator.

Stock Option Tax Calculator Calculate the costs to exercise your stock options - including taxes. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Subtracting the 10000 it would cost to exercise the options shows a pre-tax.

My startup stock options calculator Real Finance Guy RFG Stock Option ISO Value Estimator Number of Shares in Grant Current Value Per Share Total Number of Shares. Option value calculator Calculate your options value. We pull financial information on the company you entered from Finnhub.

We calculate the volatility of that company using the share price data. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Free Option Calculator based on Black-Scholes with Call and Put Prices Greeks and Implied Volatility Calculation.

Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days. Stock Options Calculator for Employee Stock Option Valuation. This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated.

The Black Scholes option calculator will give you the call option price and the put option price as 6567 and 930 respectively. The data and results will not be saved and do not feed the tools on this. According to the calculator at the end of five years 500 shares of stock will be worth 13224.

The calculator requires a total of five inputs including. The algorithm behind this stock options calculator applies the formulas explained below. Lets say we have a call option on IBM stock with a price.

This calculator can be used to estimate the potential future value of stock options granted by your employer. Assumptions and limitations of the Black.

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

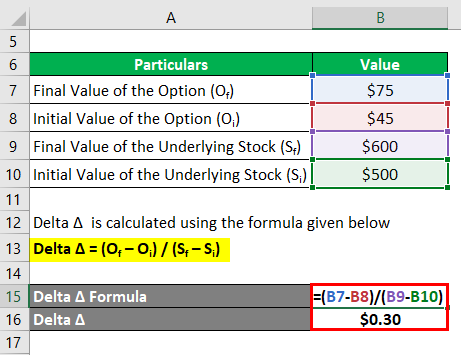

Delta Formula Calculator Examples With Excel Template

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Startup Equity Value Calculator By Triplebyte

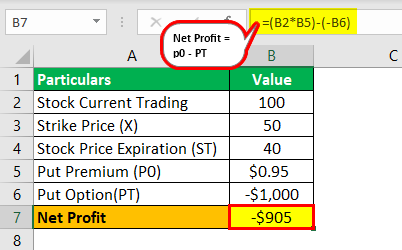

Put Options Definition Types Steps To Calculate Payoff With Examples

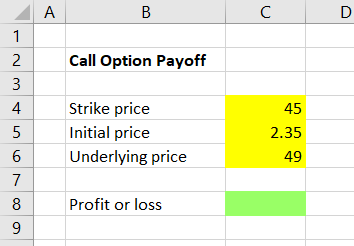

Calculating Call And Put Option Payoff In Excel Macroption

Theta Varsity By Zerodha

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Treasury Stock Method Tsm Formula And Calculator Excel Template

Calculating Call And Put Option Payoff In Excel Macroption

Treasury Stock Method Tsm Formula And Calculator Excel Template

Pricing Options Strike Premium And Pricing Factors Nasdaq

Understanding The Binomial Option Pricing Model

European Option Definition Examples Pricing Formula With Calculations

Call Option Calculator Put Option

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption