401k calculator payout

It is a government tax. - solve for the annuity payout.

401k Calculator

Mortgage calculator with taxes and insurance.

. Advisor introduced at no cost to the plan sponsor. Fixed a bug where the Retirement Income in the. For instance lets assume a contract with the following terms.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Retirement Payout Calculator. Example of a calculation.

Enter your account balance. In fact in Q1 of 2019 Fidelity reported that the average 401k employer match contribution reached an all-time high at 1780. In the United States an IRA individual retirement account is a type of retirement plan with taxation benefits defined by IRS Publication 590.

Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K. Payout Amount While an IRA or 401k may not count as an asset an applicant needs to be aware that a retirement plan in payout status may push them over Medicaids income limit. Can I Buy An Annuity With My IRA or 401k.

This calculator takes an account balance and interest rate and determines either how long you can withdraw a fixed amount of money from it or how much you can withdraw over a fixed amount of time. Financial 401k calculator. It also lets you avoid the 10 penalty taxThis approach is also called 72t payments because the rule falls under IRS code section 72t.

FIDUCIARY TRAINING PLAN SPONSORS CAN USE. College Savings Calculator 529 Savings Plan Overview. Expand How Does a Variable Annuity Work.

If your contract says the payout rate is 5 on a 100000 annuity for example then you will receive 5000 worth of payments every year covered by the contract. Employers dont have a specific 401k contribution limit placed on them but the IRS limits 401k contributions from all sources including employer match to 56000. Use this income annuity calculator to get an annuity income estimate in just a few steps.

Find advanced calculator options here. 401k CRPA is the perfect tool to help you develop relationships with plan sponsors. Are there any other types of charitable trusts.

For example in the payout schedule you can enter additional withdrawal amounts to either add to or reduce the amount of a withdrawal for a specific period. Hence before you finalize your investment decision you need to make sure you understand the meaning of the dividend yield. The reason youre permitted to roll over these payments into an annuity tax-free is because when you buy an annuity with IRA or 401k money the first thing the insurance company does is create an.

401k CRPA TM is a non-intrusive plan sponsor initiated fiduciary training and fee comparison tool. Each funds actual annual payout may vary from one year to the next and over time due to several factors including without limitation the interest rate environment the performance of the financial markets in. I still consider this spreadsheet a work in progress but I think its finally at a point where people can try it out.

How money from an inherited 401k is taxed. And of course because it is a spreadsheet you can delve deep to figure out exactly how the formulas work. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

If the account has between 1000 to 5000 the Internal Revenue Service generally requires that the company roll your funds to a new IRA account. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement. - solve for the principal required.

401k Tax Advantage. Work with the executor of the estate and 401k plan sponsor to discuss your payout options. I put this spreadsheet together after receiving numerous requests for a spreadsheet that combined my 401k savings calculator with my retirement withdrawal calculator.

Selecting the Payout on Your Annuity. These payments are also called SEPP payments. This first calculator shows how your balance grows during your working years.

-N Time in years to payout-12 n Time in years to payout-n Time in years to payout-1 i Inflation rate100. Example of 3 results. The mandatory payout rule doesnt apply to minors until theyve reached the age of majority at which point they have 10 years to empty the account they inherited.

Enter desired number of years or desired monthly payout below. With this dividend yield calculator we aim to help you to calculate the dividend yield of your stock investmentsThe dividend yield is deemed to be the most important metric to analyze dividends. Mortgage calculator with extra payments.

Calculation of the payout length in years. 18 - Annual return rate. For the sake of simplicity and to demonstrate the concept this calculator treats income from the charitable trust as 100 ordinary income.

- Final balance at the retirement. If youve inherit a 401k. Of years to payout.

A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the. As a general rule of thumb in 2022 most states have an income limit of 2523. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time.

This might mean you have a new plan with your new employer or that the funds can. 401k Should Your 401k Be in an Annuity. For purposes of this calculator this is the most accurate way to calculate tax liability on income from the trust while keeping it simple at the same time.

Annual Post-Tax Amount. 401k Calculator - Estimate how your 401k account will grow over time. We have prepared this document to help.

In case of a plan that assumes an available principal amount of 200000 with a return rate of 5 and a desired withdrawal amount of 1500 expected month by month the results displayed are. SmartAssets retirement calculator looks at your current and projected savings to determine whether youre on pace for a secure retirement. The Substantially Equal Periodic Payment rule allows you to take money out of an IRA before the age of 59 12.

Should I Put an Annuity into My 401K. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution. Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary 401K Interest Rate Sales Tax More Financial Calculators.

In some cases its possible to withdraw from retirement accounts like 401ks and individual retirement accounts before your retirement age without a penalty. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. Often your employer s 401 k doesnt allow them to pay you out with a check if your old 401 k account contains more than 1000.

Yes you can move your IRA or 401k to an annuity tax-free.

With Age Comes Great Responsibilities And At The Top Of Your List Should Be Taking Charge Of Your Money Www Levo Com Finance Personal Finance Budgeting Money

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Customizable 401k Calculator And Retirement Analysis Template

Retirement Savings Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

7 Best Free Online 401k Calculator Websites

Retirement Withdrawal Rate Calculator Financial Calculators Retirement Calculator Retirement Portfolio

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement Withdrawal Calculator For Excel

Annuity Calculator Due

7 Best Free Online 401k Calculator Websites

7 Best Free Online 401k Calculator Websites

Personal Capital Retirement Calculator Plan 1 Retirement Calculator Retirement Planner Money Design

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

7 Best Free Online 401k Calculator Websites

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

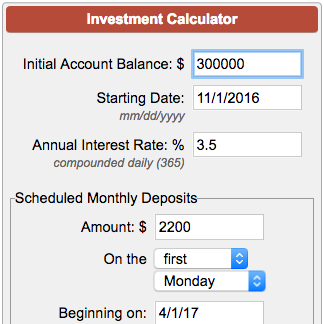

Investment Account Calculator