20+ Estimate my mortgage

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. But you dont have to put 20 down to buy a house.

/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example

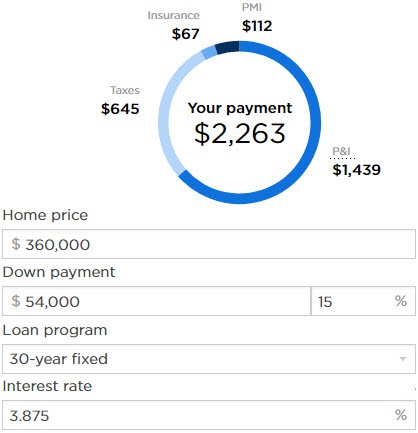

The calculator will estimate your monthly mortgage payment including principal and interest plus taxes and insurance costs.

. Estimate your monthly loan repayments on a 300000 mortgage at 4 fixed interest with our amortization schedule over. According to mortgage aggregator FAST the major banks conceded market share to non. Jun 20 Stock drop has erased 3 trillion in retirement savings this year With Americans nest eggs mostly held in 401ks and IRAs the swoon could force many to delay their retirement.

Use our free mortgage calculator to estimate your monthly mortgage payments. Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. Texas is the second-most populous state in the United States after California.

Earn unlimited 2X miles on every purchase every day. Some loans like VA loans and some USDA loans allow zero down. So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax.

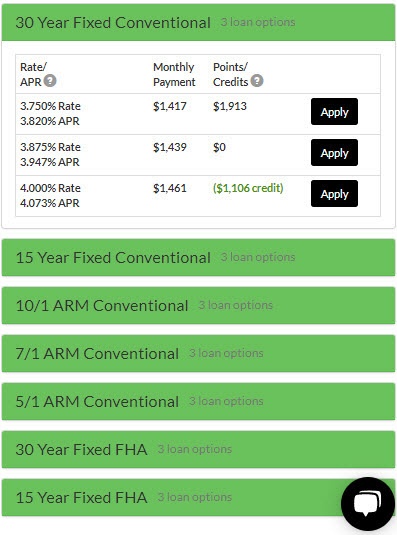

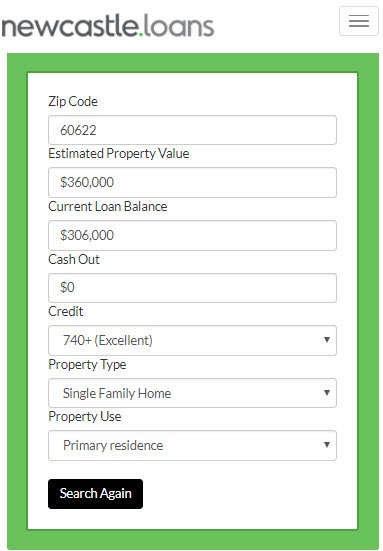

Interest rate estimate available without undergoing a hard credit check. A fixed 20-year mortgage. Enter your home price down payment interest rate taxes and insurance to get your estimate.

This is a vital part of the loan application. How much income you need depends on your down payment loan terms taxes and insurance. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Enjoy a one-time bonus of 75000 miles once you spend 4000 on purchases within 3 months from account opening equal to 750 in travel. View estimated house payments on 30-year fixed and other popular loan terms. But you may not need that much.

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. A 20-year fixed mortgage has a flat interest rate for the full 20 years. Costs that can increase by up to 10 percent.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. But you can estimate your payment using todays average mortgage rates. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

A down payment of 20 or more helps you get a lower interest rate and avoid paying private mortgage insurance. 20-40 Lenders pull your credit when you apply for a loan. 5 7 10 15 and 20 years.

PMI typically costs between 05 to 1 of the entire loan amount. How does a 20-year fixed-rate mortgage compare to a 5-year ARM. Texass Rio Grande Valley has seen.

The payment calculation may also include. Have the following information handy. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. In 2010 Texas had a census population of 25145561. Monthly mortgage payments remain the same while principal and interest totals vary with amortization throughout the life of the loan.

If the down payment amount is less than 20 the lender may require PMI if the loan amount is more than 80 of the purchase price. Fees paid to the lender mortgage broker or an affiliate of either the lender or mortgage broker for a required service. When you take out a mortgage you agree to pay the principal and interest over the life of.

An estimated 788000 lived in Texas from 15 to 19 and 20 years or more. The loan is secured on the borrowers property through a process. Use this mortgage calculator to estimate your monthly mortgage payment.

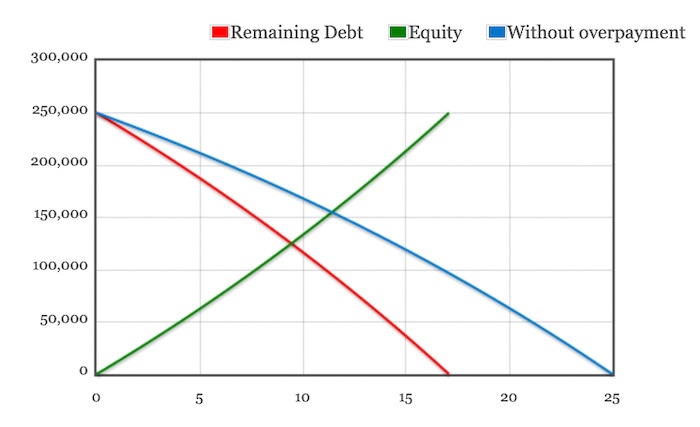

Mortgage Calculators. Account for interest rates and break down payments in an easy to use amortization schedule. If you buy a 200000 house your private mortgage insurance will cost roughly 2000 annually or 14000 over the course of seven years.

Conventional loans require just 3 down and 20 down is required to avoid mortgage insurance. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

LMI borrowers need a 20 deposit in most cases. Use our mortgage payment calculator to see how much your monthly payment could be. An MMM-Recommended Bonus as of August 2021.

Although its a myth that a 20 down payment is required to obtain. This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates. Lenders mortgage insurance LMI can be expensive.

Mortgage broker fee 0-1 of the loan amount. Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20. But maybe 20 15 or 10.

5000 up to total balance of eligible loans. Mortgage insuranceIf your down payment is less than 20 of the cost of your house many lenders will require you to pay an additional fee called private mortgage insurance or PMI. The figures provided should be used as an estimate only should not be relied on as true indication of your home loan repayments or a quote or indication of pre-qualification for any home loan product.

What is a 20-year fixed-rate mortgage. The 2015 Texas Population Estimate program estimated the population was 27469114 on July 1 2015. Refinance rates valid as of 31 Aug 2022 0919 am.

Once the equity in your property increases to 20. Fees for required service that the lender did not allow you to shop separately for when the provider is not affiliated with the lender or mortgage broker. The best way to get an accurate estimate of your loans costs is after your mortgage application is processed and you receive an itemized closing cost sheet from your lender.

Compared to the more popular 30-year mortgage a 20-year loan lets the homeowner shave a decade off the term and save significantly on interest payments over the life of the mortgage. A down payment of 20 or more will get you the best interest rates and the most loan options.

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Mortgage Payment Calculator Refinance Calculator Closing Costs Calculator More

Term Loan Calculator Estimate Your Loan Payment Upwise Capital

Downloadable Free Mortgage Calculator Tool

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Mortgage Calculator Vic Joshi Mortgage Consultant

Downloadable Free Mortgage Calculator Tool

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How To Get A Reliable Mortgage Rate Quote In 1 Minute

The Evolution Of Subprime Mortgage Defaults In The United States The Download Scientific Diagram

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Types Of Home Loans Amerhome Mortgage

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Rental Property Calculator Most Accurate Forecast

How Much Is A Mortgage Calculator Quora

Downloadable Free Mortgage Calculator Tool

Types Of Home Loans Amerhome Mortgage